SBA 504 Loans

Long-Term Financing for Business Growth

Financing designed for small business needs.

Grow Your Business with Funding For

Professional Fees

Acquisition of Existing Building

Building Expansion or Renovation

Purchase of Land

Construction

Purchase Equipment

Lender's Interim Points & Interest

Debt Refinance

Financing Structure

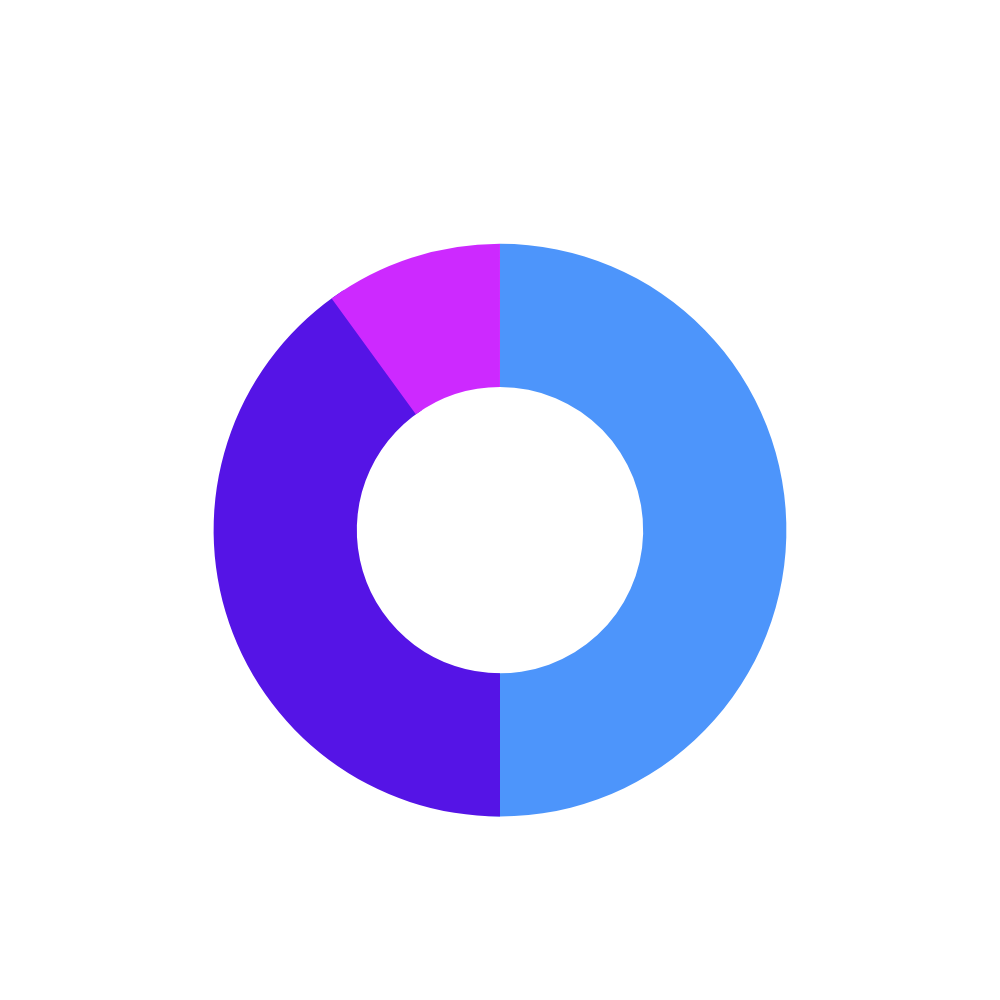

The typical SBA 504 Loan structure is as follows: 50% lenders note, 40% SBA 504 note and 10% borrower contribution.

Lender (50%) , CDC / SBA 504 (40%) , Borrower Contribution (10%)

Current Rates

6.583%

25-year debentures 25-year debentures Tooltip

6.637%

20-year debentures 20-year debentures Tooltip

7.076%

10-year debentures

Benefits of the SBA 504 Loan

For Borrowers

Finance up to 40% of the project at a long-term, fixed rate

Debt refinancing available

Lower equity contribution as little as 10% of project to preserve working capital

Eligible soft costs may be rolled into the project financing

For Lenders

Strengthen lender loan portfolio with 1st lien position and low Loan-to-Value

Preserve borrower's working capital

Fixed interest rate helps lenders compete for more business

Offers creative financing to differentiate your lending institution in the marketplace

Why the SBA 504 Loan is Right for You

Low down payment

Conserve working capital

Fixed interest rate

Rate locks-in at funding

Refinancing

Potential refinancing of existing debt related to fixed assets

10, 20, or 25-year terms

Brings debt service in line with cash flow generated by the asset

Improve collateral position

To increase borrowing capacity at lower rates

SBA 504 Loan Eligibility Requirements

For-profit, owner-occupied small business

Net worth is less than $15 million

Net profit is no more than $5 million

2 yr average after tax profit including affiliates

SBA 504 Loan Programs

-

Providing up to 90% financing for commercial property and equipment purchases.

➥ For-profit, owner-occupied small businesses in U.S.

➥ Net worth is less than $15 million

➥ Net profit after tax (2-year average) of no more than $5.0 million (including affiliates)

-

Co-Lender financing designed to refinance existing commercial real estate or equipment debt.

➥ For-profit, owner-occupied small businesses in the U.S.

➥ Businesses with at least 2 years of operations and whose debt is at least 6 months old.

➥ Business must occupy at least 51% of its property at the time of application

-

Secure up to $5.5 million for projects that meet SBA's green energy standards and meet one of the following goals to qualify:

➥ Reduce energy use by 10%

➥ Renewable energy sources that generate at least 15% of the energy used

➥ Increased use of sustainable designs

Find Your Loan Officer Today!

Feel confident knowing we are the leading non-profit provider of small business financing. Our Loan Officers are experts and have been helping people fund their dreams since 1993.

Frequently Asked Questions

-

Timeframe of loan volume at SBA and Capital CDC loans may differ. Due to SBA assessment procedures that help maintain program integrity, processing can sometimes extend over an extended duration. Factors to take into consideration in making a determination include the complexity and volume of applications received at the SBA during any given time, nature of proposed project, and specific details provided by applicant. Applicants can streamline this process by providing a thorough, well-organized application. In addition to these variables, regional Loan Officer insights may prove indispensable - providing context-specific guidance as well as up-to-date status checks - but communication remains of utmost importance with such a multifaceted process. Choosing SBA 504 lenders like Swift that know the process well will help guide you through this.

-

The rates lock in at funding. All SBA 504 loans take advantage of fixed interest rates set a week prior to loan disbursement after completion, offering businesses significant advantages when facing unpredictable markets and dealing with risks such as market upheaval. By locking-in these fixed rates early enough in their project's lifespan, businesses gain clarity for financial strategizing and resource allocation decisions; ultimately providing greater protection from potential market turbulence. To get started and get your rate locked in you can go to the SBA 504 loan application here.

-

SBA financing opportunities exist for most for-profit, owner-occupied businesses in the U.S. that fall into its "small" classification; however, certain sectors and fields fall outside its purview. Exclusions apply to nonprofits, firms with an emphasis in lending activities, real estate-centric enterprises, oilfield development entities and adult entertainment businesses. The SBA has carefully constructed its eligibility criteria in line with their overall mission of stimulating economic development, encouraging entrepreneurialism, and stimulating job creation. Due to the complexity and variety of business models present, consultation with a regional Loan Officer may prove essential in clearing away ambiguities, offering tailored guidance, and making sure applications align properly with SBA criteria.

-

Swift SBF makes the process of applying for SBA 504 loans easy when they submit a comprehensive application package and Good Faith Deposit of either 1% of your proposed loan or $2,500 (whichever is less). This deposit represents more than just procedural compliance - it symbolizes serious intent by applicants, reinforcing mutual commitment between Swift SBF and their borrower; in return Swift SBF dedicates significant resources and expertise towards carefully reviewing each application submitted - this initial phase shows Swift SBF's dedication to transparency while building lasting relationships with its clientele. To learn more about the SBA 504 loan application process contact our team!

-

Borrower Injection serves as the cornerstone of every SBA 504 program as detailed by its loan Authorization document. More than just financial contributions, this down payment represents faith that this project can succeed based on financial considerations alone. Each element of this injection undergoes thorough documentation, underscoring our commitment to transparency. Furthermore, the Use of Proceeds sheds light on where our loan's proceeds have gone over time. Detail every allocation dollar allocated toward real estate purchases, machinery acquisition or any construction endeavors. Doing this ensures all stakeholders involved - both borrower and bank alike - remain aware of all loan details while building trust between all involved. This process helps the loan meet its overall goals more successfully.

-

Swift SBF (one of the leading SBA 504 lenders) recognizes the value of efficient financial operations when businesses seek to capitalize on market opportunities or meet immediate financial requirements. Our financial professionals recognize this priority. Swift SBF provides ways for loan closure to happen more rapidly by forging strong alliances between themselves, the Closing Officer/Attorney, providing documents in a timely fashion, and staying proactive during their loan processes. By joining forces and being proactive, borrowers can greatly speed up this part of the loan process. Swift SBF provides training sessions and resources to educate borrowers on best practices. Swift's collaborative approach ensures every application goes through a detailed examination process while borrower participation can increase speed significantly. Swift SBF and its clients collaborate effectively in providing an ideal environment for efficient loan processing. Open communication channels, timely documentation submission and anticipatory action to mitigate potential roadblocks all ensure an expedient loan process that maximizes potential and business growth. With deep knowledge of the SBA 504 loan requirements Swift is able to help you get funded quicker.

-

Swift SBF goes well beyond simply providing financial provision; we also offer comprehensive legal support. Navigating through an ever-evolving legal landscape with its intricate provisions and clauses may seem daunting at times; our commitment includes comprehensive assistance when faced with such complexity. Swift SBF recognizes this challenge by offering access to attorneys with experience handling the SBA 504 program and their unique requirements. Their guidance can prove indispensable, helping interpret complex jargon as well as navigate regulatory SBA 504 loan requirements and potential legal pitfalls successfully. Swift SBF experts ensure every legal provision is carefully respected while simultaneously equipping borrowers with insights to prepare them for each phase of the loan process. In addition, these specialists foster an environment conducive to cooperation by working directly with borrowers on concerns or answering queries while clarifying information, reinforcing Swift SBF's dedication towards offering transparent loan experiences inclusively and transparently.

-

Yes. Swift SBF and SBA understand that businesses require flexibility. Therefore, provisions have been put in place to accommodate post-approval modifications such as cost overruns, property acquisition or changes in equipment procurement plans that need addressing post approval. Swift SBF reviews any proposed changes carefully to ensure they comply with SBA core principles. In addition to taking an objective stance when reviewing changes proposed, Swift SBF also emphasizes a consultative approach wherein potential borrowers are provided advice regarding implications and benefits of changes being considered for adoption. This guidance equips borrowers to make educated choices. Communication, documentation and justification for changes are vital in order to integrate them smoothly while meeting borrower objectives without jeopardizing loan integrity.

-

Financial ecosystem of SBA 504 loans is complex. Bank closure is the start, establishing resource allocation; while Community Development Center (CDC) closing completes it. Each step in this complex and intricate process requires professional handling with proper oversight from experts in each field. While this two-prong strategy ensures thoroughness, its associated costs often raise eyebrows. Furthermore, these charges cover administrative, operational, and due diligence expenses that both entities inevitably incurred during this process. Reimbursement provisions of 504 loans demonstrate their dedication to fairness and transparency. Swift SBF stands by its pledge of client care by making certain borrowers are adequately compensated for any costs, reflecting our unyielding dedication to fairness, transparency, and client wellbeing - while simultaneously offering an effortless lending experience.